Enroll in a Live Loan Officer Training Webinar Today!

20-Hour Live Webinar with Test Prep Package

Now Starting At $325!

October 7th, 8th, & 9th

November 4th, 5th, & 6th

December 2nd, 3rd, & 4th

Private group? Schedule directly at [email protected]!

Online Loan Officer Training With Live Webinars

Get your NMLS license quickly and confidently with our instructor-led live online loan officer training webinars! The NMLS now allows everyone to obtain their mortgage loan originator license via a live webinar course. Live webinar courses are great for individuals who can dedicate more time per day to obtain their loan origination license quickly. Best of all, with Mortgage Educator’s experienced instructors, you will be receiving great industry insight. Instead of attending a live pre-licensing course, why not complete the NMLS pre-licensing requirements from the comfort of your home?

Webinar Format Mortgage Loan Officer Classes Online - What To Expect

Our online mortgage license classes consist of 2 or 3 evenly distributed days of webinar sessions. There will be a live instructor teaching and administering the webinar. Active participation and completion of the course assignments are required to obtain your license. Mortgage Educators & Compliance will report the hours of required education you’ve completed to the NMLS. At the end of the final day, you will take a comprehensive final exam. Passing the final exam is the last step in completing the NMLS mortgage education pre-licensing requirements! To reserve a spot in one of our live online mortgage license classes, choose from the pre-scheduled webinars shown above or call one of our licensing specialists today!

For additional information, or to schedule your live mortgage loan officer classes online call one of our licensing specialists at:

Call (801) 676-2520

Online Self-Study

Get your CE for as low as $84.99 — use code SAVENOW at checkout!

Select Your States To Purchase Below

Arizona's 4-hour RI and Utah's 5-hour Post-Licensure

are

not included in the selector.

CLICK HERE

for the AZ Responsible Individual Course Product

Select Your State-Specific Electives To Purchase Below

Only state-specific CE hours will be added using this

selector.

Only states with additional state-specific CE hours will

show.

Arizona's 4-hour RI and Utah's 5-hour

Post-Licensure

are not included in the selector.

CLICK HERE

for the AZ Responsible Individual Course Product

Select Your States To Purchase Below

Arizona's 4-hour RI and Utah's 5-hour Post-Licensure

are not included in the selector.

CLICK HERE for the AZ Responsible Individual Course Product

Select Your State-Specific Electives To Purchase Below

|

Only state-specific CE hours will be added using this selector. Only states with additional state-specific CE hours will show. Arizona's 4-hour RI and Utah's 5-hour Post-Licensure are not included in the selector. CLICK HERE for the AZ Responsible Individual Course Product |

|

Why MLOs Like Mortgage Educators Online CE Renewal Courses

Flexible and Valuable

Our industry-leading pricing means you get incredible value no matter which course you're taking. We offer a price match guarantee, making us the best option no matter what the competition may offer. When you complete your NMLS CE with Mortgage Educators, you can choose the classroom format that works for you, whether it's in person, a live webinar, or an online self-study course with webinar recordings. All formats include engaging, relevant content and excellent customer support.

Well-Reviewed and Dependable

With strong MLO testimonials, high reviews on TrustPilot, and Google reviews, Mortgage Educators is the clear choice for your CE courses when you're ready to renew your license. When you have to complete CE courses every year, it's smart to stick with a provider you can rely on. Mortgage Educators stands out as the premier CE provider for our fresh content, high reviews, and expert team. The Successive Years Rule has led some MLOs to believe the myth that they must take CE from a different provider every year, when really the rule simply states that they cannot take the same course two years in a row. Fortunately, Mortgage Educators writes a brand new course every year, meaning you'll always get the most relevant education, and you'll never have to worry about whether or not you're meeting the Successive Years Rule requirement

What to Look For in a CE Provider

Fresh Content

Choosing a CE provider with fresh content will ensure you meet the Successive Years Rule and never inadvertently take the same course two years in a row. If a provider offers multiple CE courses, there's no way of knowing when each one was created so their mortgage training may be out-of-date. It's much better to go with a provider that is constantly creating new content to meet new guidelines.

Multiple Formats

Everyone has their own preferred learning style. While some may flourish with in-person classes, others may want an online course that can be completed on-the-go. When selecting a CE provider, it’s best to choose one which offers multiple course formats and instruction styles so that you'll be able to learn in your preferred format, style, and schedule.

Reputation

Before choosing a CE provider, make sure you do your research to see what others are saying about them. Do they have good Google and Trustpilot reviews? Do they have positive comments on social media? The best CE providers will have a strong online reputation and a good sampling of customer testimonials.

Don’t have your NMLS license yet?

Welcome My Mortgage Trainer Students to

Mortgage Educators and Compliance!

Mortgage Educators and Compliance (MEC), a trusted leader in mortgage education and compliance — and a proud member of the 360training family — is excited to welcome My Mortgage Trainer (MMT) into the MEC community.

As part of this transition, you now have flexible, convenient options to complete and maintain your NMLS MLO license through MEC:

- Online Self-Paced Course – Study anytime, anywhere with 24/7 access.

- Live Webinar Course – Join engaging, instructor-led sessions in real time.

We’re thrilled to support your success with the same quality training and commitment you’ve come to expect.

MEC Login

Access your MEC account using the login link at the top of this page to view:

- Courses purchased on or after August 15, 2025

- Webinar content available after May 12, 2025

MMT Login

Click here to access your My Mortgage Trainer (MMT) account for:

- Courses in progress before August 15, 2025

- Any other MMT course-related records

How do I know which login to use?

If you originally created your account or purchased a course through MMT, those credentials are still valid for accessing historical course information or completing a course purchased before August 15, 2025.

All new course purchases and webinar signups will be through MEC, requiring a new set of login credentials.

This change allows us to provide a more seamless and flexible learning experience while continuing to offer the same trusted content. Whether you prefer online self-paced courses or live webinars, you’ll now have more options to meet your NMLS MLO licensing requirements through our relationship with MEC.

If you have any trouble accessing either LMS or need assistance, we’re happy to help! Contact us at [email protected] for assistance.

2021 Continuing Education

Please note: Continuing Education or Late continuing education courses are only valid in the year purchased.

The NMLS requires all licensed MLO's to take a minimum of 8 hours of continuing education each year, as well as any state-required electives. We offer continuing education in a variety of formats for the NMLS renewal process.

NMLS-Approved Late Continuing Education

-

If CE hour requirements change, the MLO must meet the new requirements after the effective date of the new requirement.

-

If an MLO gets their license between November 1st and December 31st, they will not have to complete CE that year.

NMLS Renewal Process & Mortgage CE Courses

Just as doctors and lawyers have ongoing medical and legal training, loan officers need to continue taking education courses in order to renew their NMLS licenses. This ensures that mortgage loan originators (MLOs) have the knowledge needed to do their jobs correctly, year in and year out.

If you're an MLO wondering when and where to take your next NMLS renewal mortgage CE course, check out our guide below. We'll explain everything you need to know about mortgage CE courses and requirements.

NMLS Mortgage CE Course Requirements

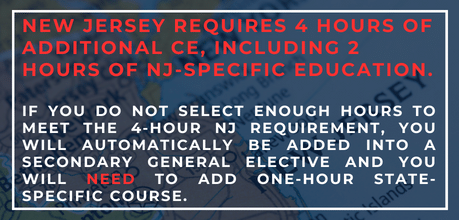

Every state requires MLOs to complete 8 hours of NMLS-approved online classes before renewing their license each year. To begin this course work, you'll need an NMLS ID Number, which can be confirmed with your provider.

The SAFE Act requires MLOs with a state license to complete additional education requirements, including:

-

3 hours of federal law and regulation

-

2 hours of ethics

-

2 hours of training on lending standards for non-traditional mortgages

-

1 hour of undefined courses on mortgage origination

Many MLOs are unaware of the nuances when it comes to continuing education (CE) rules. Here are some lesser-known policies to be aware of when completing the required NMLS renewal courses:

-

CE can be completed any time up until the renewal date, meaning MLOs can start working on them as early as January 1st.

-

CE must be completed in the same year of licensure, unless federal PE was completed in the same year.

-

A late CE is required for an MLO returning to the industry.

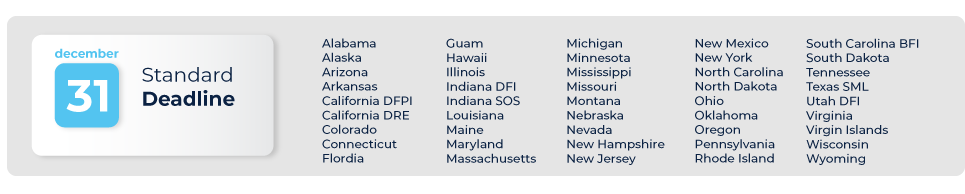

Upcoming Continuing Education Deadlines

Each state has different education completion deadlines. Please double check your state's deadlines with the NMLS. Remember the NMLS SMART Deadline to complete your Continuing Education is on Friday, December 11th.

Continuing Education Course Access will end on Monday, December 28th. No refunds will be granted to those with unfinished courses due to this deadline.

|

October

Saturday, Oct. 31st Georgia

|

November

Sunday, Nov. 1st Washington D.C. West Virgina

Monday, Nov. 30th Kentucky South Carolina-DCA

|

December

Tuesday, Dec. 1st Delaware Idaho Iowa Kansas Vermont

Tuesday, Dec. 15th Utah-DRE Washington |

Why MLOs Like Mortgage Educators Online CE Courses

Mortgage Educators has been approved with NMLS since 2010, teaching tens of thousands of students nationwide every year. As a leading CE provider, Mortgage Educators offers all CE courses for every state requirement, including late CE for any state. Our seasoned customer support team and CE licensing specialists will ensure you get the right educations for your NMLS renewal needs.

Flexible and Valuable

Our industry-leading pricing means you get an incredible value no matter which course you're taking. We offer a price match guarantee, making us the best option no matter what the competition may offer.

When you complete your CE with Mortgage Educators, you can choose the classroom format that works for you, whether it's in person, a live webinar, or an online self-study course. All formats include engaging, relevant content and excellent customer support.

Well-Reviewed and Dependable

With strong MLO testimonials, high reviews on Trustpilot, and Google reviews, Mortgage Educators is the clear choice for your CE courses. When you have to complete CE courses every year, it's smart to stick with a provider you can rely on. Mortgage Educators stands out as the premier CE provider for our fresh content, high reviews, and expert team. You can even hire our president and mortgage industry expert, David Luna, to come speak at your next event, giving you an entertaining and education way to complete your CE requirements.

The Successive Years Rule has led some MLOs to believe the myth that they must take CE from a different provider every year, when really the rule simply states that they cannot take the same course two years in a row. Fortunately, Mortgage Educators writes a brand new course every year, meaning you'll always get the most relevant education, and you'll never have to worry about whether or not you're meeting the Successive Years Rule requirement.

What to Look for in an NMLS-Approved CE Provider

When choosing a CE provider, it's important to seek out a reputable NMLS-approved company that offers customer support and will give you the best education possible. Choosing an NMLS-approved provider will guarantee a higher standard of education, since these providers must undergo rigid renewal process each year. Here are some other things to look for when choosing a CE provider:

Fresh Content

Choosing a CE provider with fresh content will ensure you meet the Successive Years Rule and never inadvertently take the same course two years in a row. If a provider offers multiple CE courses, there's no way of knowing when each one was created so their mortgage training may be out-of-date. It's much better to go with a provider that is constantly creating new content to meet new guidelines.

Multiple Formats

Everyone has their own preferred learning style. While some may flourish with in-person classes, others may want an online course that can be completed on-the-go. Select a CE provider that offers multiple course formats, and you'll be able to learn in the style that works for you and your schedule.

Reputation

Before choosing a CE provider, make sure you do your research to see what others are saying about them. Do they have good Google and Trustpilot reviews? Do they have positive comments on social media? The best CE providers will have a strong online reputation and a good sampling of customer testimonials.

Start Your NMLS Renewal Courses Today

At Mortgage Educators, we're experts in licensing and education for MLOs. Contact our seasoned professional team to learn more about our CE courses, or to ask any questions you might have about our courses.

Don’t have your license yet?

Late Continuing Education is required for all MLO's who once had an active license, who want to reactivate their license. Please note that requirements vary by state.

We recommend calling the NMLS to see what may be required.

NMLS phone # 855-665-7123