Mortgage Educators Offers Your Company's Education Needs,

NMLS Courses, Live CE/PE, and Specialized Training

|

{component index.php?option=com_ckforms&view=ckforms&id=223}

For questions about how you can get started on these great deals for your company or branch, call Mortgage Educators and Compliance at 877-403-1428. |

Andy M. Utah

In all my years I've never had such a positive experience with a CE class...much less an eight hour long MLO SAFE class!

Robert S. California

"If there is a master craftsman in the field of mortgage loan originator education, it is David Luna. Our industry has been tasked with some of the most burdensome requirements one could imagine and yet David has found a way to make the information accessible and even fun.

|

4 Reasons Why Becoming a Mortgage Broker or Loan Officer May Be the Career Change You've Been Looking For

What is a Mortgage Loan Officer?

Loan officers, also commonly referred to as "Mortgage loan originators" or "MLOs", are individuals employed by banks or financial institutions to help recommend the right loan to potential homebuyers. Loan officers are monitored by the Nationwide Mortgage Licensing System or NMLS, through which they obtain a license. This license is required both nationally and at the state level for loan officers to originate loans.

Mortgage Loan Officer vs. Mortgage Loan Broker

MLOs are commonly confused with mortgage brokers. If you are confused on the difference, perhaps this can help. When a homebuyer wants to get a loan, the homebuyer finds a mortgage broker to broker the loan. That means that the broker finds a loan officer to help originate that loan. Oftentimes, the mortgage broker works in the same office and manages loan officers.

So what's the difference between the two when it comes to education? To put it simply, nothing. Mortgage brokers and mortgage loan officers both must complete the same education requirements in order to obtain their license to operate in their state or states.

4 Perks to Being a Mortgage Broker or Loan Officer

Hopefully we have helped to clear up some initial confusion on the differences and similarities between a mortgage broker and loan officer. So that leaves the question: why should I become a mortgage broker or loan officer anyway?

We are glad you asked. Here are 4 things that we think makes this industry special and a sure-shot for anyone who is contemplating making the switch.

#1. Unlimited Income Potential

The mortgage industry is a self-starter industry. Most mortgage professionals are paid on commission with a percentage of each loan generated going towards the loan officer's paycheck. This mean that the income potential for each loan officer is only limited by their drive to originate loans by marketing their business and making connections. To put it plain and simple, you get out what you put in. The average commission for a loan officer is around 2% on every loan originated. The 2% rate is somewhat standard by regulations set in 2011 by the Federal Reserve Board.

To illustrate this average, let's say that a loan officer originates one $250,000 during the month.

$250,000 loan X 2% = $5,000

The 2% commission on that $250,000 loan that the officer originates will give the MLO $5,000 in commission for that one loan. If over the course of a year the MLO closed one loan per month over 12 months, that loan officer will have made $48,000 that year. Keep in mind that this scenario assumes only one loan originated a month. Most loan officers can close anywhere from 18 to 25 loans in a year, with some doing as many as 35 to 40. According to U.S. News, which ranks loan officers as #14 on its list of Best Business Jobs, the average salary for a loan officer in 2015 was $63,430 with the upper 75th percentile making over $90,000.

But that income comes at a cost: hard work. Originating mortgage loans is not a simple walk-in-the-park job. The life of a mortgage broker or loan officer is one that takes deadline management, marketing, communication skills and a desire to succeed. The industry also demands much from its loan officers as there are a number of government regulations, rules and laws to abide by in order to obtain and maintain a MLO license.

#2. Flexible Schedule and Lifestyle

After pay, one of the biggest perks of any career is how flexible it allows you to be. The good news is that mortgage brokers and loan officers work in one of the most flexible environments in the nation. Loans can be originated anywhere and everywhere. As long as you have a cell phone and computer with an internet connection, you can originate loans. Your reach is only as far as your license allows you to go! You could be in California and close a deal in Guam, or in New York closing a deal in Kentucky.

The flexibility and functionality of your license demonstrates the importance of choosing the right educator for obtaining your license. It is important so that you can find an education provider that is knowledgeable about the industry, can answer your questions, but can also provide you a wide range of education options to tailor your license to your individual needs. Mortgage Educators and Compliance has been in the business of mortgage education and licensing for 25 years and is a tried and true source for all your mortgage education needs. Trust us to point you in the right direction and to be with you every step of the way.

#3. Quality Market Situation

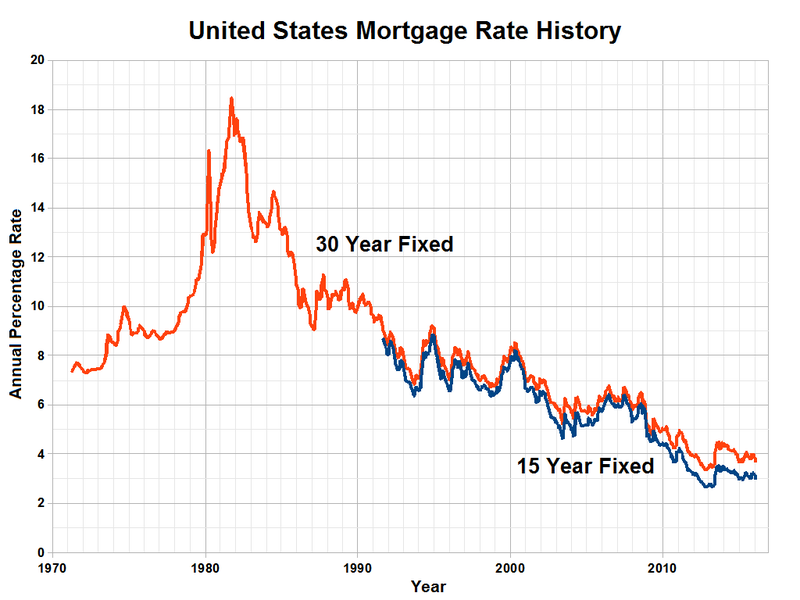

Every industry experiences its ups and downs but those holding a mortgage license can always know they have something to offer and a business that is in demand. Every day another person is looking to purchase a home in your neighborhood and you could be the one to help! Right now the industry has record low rates and they continue to fall. The below graph illustrates the trending decline in interest rates, which means more mortgages and refinances for you to originate for customers! It all depends on you and your willingness to take advantage of the opportunity.

#4. Helping People Achieve Their Home-buying Dreams

Buying a home is a scary ordeal, especially for first time homebuyers. The investment is huge and often the largest purchase any of us will ever make. So homebuyers need someone to help them through the process to make sure that securing a loan is a stress-free and simple procedure. Each loan officer has the unique opportunity to help homebuyers to secure the right loan for them so they have one less thing to worry about.

Being a mortgage broker or loan officer is a unique career that offers benefits and opportunities not found elsewhere. You've waited long enough to find the right career for yourself. Chances are that a career as a mortgage broker or loan officer is the career move you've been waiting for. It's never too late to get started on something amazing. There's an old saying -- "The best time to plant a tree is 20 years ago. The second best time is now." So get started today!

For questions about how you can get started on your way to become a mortgage broker or loan officer, call Mortgage Educators and Compliance at 877-403-1428.

NMLS License Tennessee: Get Your Tennessee Mortgage Loan Originator License in 2025!

Tennessee Education Bundle

Starting at: $399 Now Only $259!

Use Promo Code: TNPEDEAL

Licensed in another state and want to add Tennessee?

Now Only $49.98!

Use Promo Code: TNPE49

How to Get an NMLS Mortgage License in Tennessee

|

Step 1 |

Step 2 |

Step 3 |

||||||||

Apply For Your NMLS Account and ID Number |

Complete Your NMLS Pre-License Education |

Need to Pass the SAFE MLO National Test |

||||||||

The first step to obtaining your Tennessee mortgage license is applying for an NMLS account and ID number. To do so, go to the NMLS website. |

To get a Tennessee mortgage license, take the required 20 (18+2) hours of classes, including 2 hours of Tennessee-focused electives and 18 hours of general mortgage education. |

With your education complete, you need to schedule an appointment for the National Test Component exam and take the NMLS test. Find out more on how to take your NMLS exam here. |

||||||||

Step 4 |

Step 5 |

Step 6 |

||||||||

Complete Background Checks and Pay All Fees |

Apply for Your Tennessee Mortgage License |

Associate Your NMLS Account with Your Employer |

||||||||

To finalize your application and receive your license, you will need to pay several non-refundable fees and get a background check. Find out more about how to complete your background check here. |

After receiving a passing score on your NMLS mortgage exam, you need to apply for your Tennessee NMLS license. You can find more information on this step here. |

Your license will still be pending in Tennessee until you have an employer sponsorship, which lets the government know that an employer is supervising your license. Learn how to associate your NMLS account with your employer here. |

The Value of a Tennessee Mortgage License

What do you want out of a career? If you’re like others who hold an NMLS license in Tennessee, you want to have a significant impact on people in your community and state. You want to serve them in something important: making the largest purchase of their lives. If you have a sociable personality and a love of learning, your career will be filled with variety, excitement, and passion.

But how do you get through the process and complete every detail? Mortgage Educators has guided many others like you to an NMLS license. Our education bundles—taking you through your combined 20 hours of test-preparation classes—and practice tests simplify the process and get you ready for your exam. We are committed to helping you start your career as quickly and efficiently as you can.

Tennessee Frequently Asked Questions

In an effort to curb the predatory lending practices that led to the demise of the housing and residential mortgage industry in 2008, the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE) was enacted. This opened up a world of opportunity to those driven to attain an MLO license and then work hard to match people with loan products.

| Topic | Hours Required |

|---|---|

| Fair Lending, Ethics, Fraud, and Consumer Protection | 3 Hours |

| Federal Laws and Regulations | 3 Hours |

| Non-Standard Lending | 2 Hours |

| Undefined Electives | 10 Hours |

| Tennessee Specific Education | 2 Hours |

| Total 20 Hours | |

If you complete the required 20 hours of education but do not obtain your license for a 3-year period, you'll need to repeat the coursework. The same applies if you let your license lapse for 3+ years before you want to get back into the industry.

A “mortgage broker” refers to an individual or an organization that connects consumers with mortgage loans from a variety of companies. Mortgage brokers frequently employ loan officers. In contrast, a loan officer is an employee who regularly works with borrowers and provides loans that are originated by their employer. Brokers and loan officers need different types of licenses.

Earning your mortgage broker license in Tennessee should be considered an investment well worth your time. Here’s what to expect when it comes to licensing fees in Tennessee:

| NMLS Fees | |

|---|---|

| NMLS Initial Processing Fee | $30 |

| Tennessee License & Registration Fee | $100 |

| Tennessee Application Fee | $100 |

| Credit Report | $15 |

| FBI Criminal Background Check | $36.25 |

| Total License Cost | $281.25 |

On an annual basis, Tennessee MLO license holders must complete 8 total hours of Comprehensive Continuing Education that must cover:

| Topic | Required Hours |

|---|---|

| Federal Regulations and Law | 3 Hours |

| Ethics, including consumer protection, fair lending | 2 Hours |

| Non-Traditional mortgage lending | 2 Hours |

| General Elective | 1 Hour |

Remember to take into account the “successive years” rule, which prohibits loan officers from taking the same CE course two years in a row.

Mortgage Educators changes its continuing education course annually to ensure there are no issues with the successive years rule.

The deadline to complete CE in Tennessee is December 15th. MLO's in Tennessee are actually prevented from applying for license renewal until they have completed their CE.

Keep in mind you'll need to complete a background check and credit check if you have not in the last 3 years. The TN renewal fee is $100.

Mortgage Educators and Compliance is here to answer any additional questions you may have regarding your Tennessee mortgage license. For additional questions, feel free to call us at (801) 676-2520 or email us at [email protected].

Get Your Tennessee Mortgage License with Mortgage Educators

Are you excited about serving your community in Tennessee as a loan officer? Then take advantage of our special education bundle that will help you get your pre-license courses completed quickly. Gain the knowledge you need with Mortgage Educators today!

Become a mortgage loan originator in the state of Nebraska

Purchase the Nebraska all-in-one bundle which includes both NMLS approved 20 and 2 hour online courses. The 2 hour Nebraska course is given in Online Instructor Led Format. We also prepare you to take the national test component with our comprehensive test prep courses with practice questions.

This bundle is now available at discounted rate of of $399 $269

Use Coupon Discount Code: "NEPEDEAL"

Just need the 2 hour Nebraska elective? Purchase the stand alone 2 hour course!

Nebraska 2 Hour PE Course (Online Instructor Led) $59

Under Nebraska law each individual that wants to become licensed as a sponsored mortgage loan originator needs to fulfill NMLS approved pre-license education, and successfully pass the national exam. Nebraska requires 22 hours of NMLS approved pre-license education.

Confused about what you need to do? Call 877.403.1428

and speak to one of our representatives.

{/sourc

Get Your Mortgage Loan Originator License in 2023!

Tennessee Education Bundle

Starting at: $399 Now Only $259!

Use Promo Code: TNPEDEAL

Licensed in another state and want to add Tennessee?

Now Only $49.98!

Use Promo Code: TNPE49

How to Get an NMLS Mortgage License in Tennessee

If you have been asking yourself, “how do I get a mortgage license in Tennessee?”, this guide will tell you exactly how to do it. If you are wondering how to become a mortgage loan originator and get an NMLS license Tennessee is a great state in which to start. A mortgage loan originator, or mortgage loan officer, helps prospective homebuyers obtain a residential mortgage loan. The mortgage business is a fast-paced industry with plenty of opportunities for an up-and-coming mortgage loan originator.

In order to become a licensed mortgage loan originator in Tennessee, you will have to complete the steps which are outlined below. Additionally, you should consider the costs, education requirements, and other factors discussed in this guide that go into becoming a loan officer in the state of Tennessee.

Step 1

Step 2

Step 3

Apply For Your NMLS Account and ID Number

Complete Your NMLS Pre-License Education

Need to Pass the SAFE MLO National Test

The first step to obtaining your Tennessee mortgage license is applying for an NMLS account and ID number. To do so, go to the NMLS website.

To get a Tennessee mortgage license, take the required 20 (18+2) hours of classes, including 2 hours of Tennessee-focused electives and 18 hours of general mortgage education.

With your education complete, you need to schedule an appointment for the National Test Component exam and take the NMLS test. Find out more on how to take your NMLS exam here.

Step 4

Step 5

Step 6

Complete Background Checks and Pay All Fees

Apply for Your Tennessee Mortgage License

Associate Your NMLS Account with Your Employer

To finalize your application and receive your license, you will need to pay several non-refundable fees and get a background check. Find out more about how to complete your background check here.

After receiving a passing score on your NMLS mortgage exam, you need to apply for your Tennessee NMLS license. You can find more information on this step here.

Your license will still be pending in Tennessee until you have an employer sponsorship, which lets the government know that an employer is supervising your license. Learn how to associate your NMLS account with your employer here.

The Value of a Tennessee Mortgage License

A mortgage license allows mortgage loan originators to help prospective homebuyers. That begins with completing a residential mortgage loan application, which cannot be completed without first being licensed.

Ask yourself, what do you want out of a career? If you’re like others who hold an NMLS license in Tennessee, you want to have a significant impact on people in your community and state. You want to serve them in something important: making the largest purchase of their lives. If you have a sociable personality and a love of learning, your career will be filled with variety, excitement, and passion.

But how do you get through the process and complete every detail? Mortgage Educators has guided many others like you to an NMLS license. Our education bundles—taking you through your combined 20 hours of test-preparation classes—and practice tests simplify the process and get you ready for your exam. We are committed to helping you start your career as quickly and efficiently as you can.

{source}

Tennessee Frequently Asked Questions

In an effort to curb the predatory lending practices that led to the demise of the housing and residential mortgage industry in 2008, the Secure and Fair Enforcement

for Mortgage Licensing Act (SAFE) was enacted. This opened up a world of opportunity to those driven to attain an MLO license and then work hard to match people with

loan products.

Topic

Hours Required

Fair Lending, Ethics, Fraud, and Consumer Protection

3 Hours

Federal Laws and Regulations

3 Hours

Non-Standard Lending

2 Hours

Undefined Electives

10 Hours

Tennessee Specific Education

2 Hours

Total 20 Hours

If you complete the required 20 hours of education but do not obtain your license for a 3-year period, you'll need to repeat the coursework.

The same applies if you let your license lapse for 3+ years before you want to get back into the industry.

A “mortgage broker” refers to an individual or an organization that connects consumers with mortgage loans from a variety of companies.

Mortgage brokers frequently employ loan officers. In contrast, a loan officer is an employee who regularly works with borrowers and provides loans that are originated by their employer.

Brokers and loan officers need different types of licenses.

Earning your mortgage broker license in Tennessee should be considered an investment well worth your time. Here’s what to expect when it comes to licensing fees in Tennessee:

NMLS Fees

NMLS Initial Processing Fee

$30

Tennessee License & Registration Fee

$100

Tennessee Application Fee

$100

Credit Report

$15

FBI Criminal Background Check

$36.25

Total License Cost

$281.25

On an annual basis, Tennessee MLO license holders must complete 8 total hours of Comprehensive Continuing Education that must cover:

Topic

Required Hours

Federal Regulations and Law

3 Hours

Ethics, including consumer protection, fair lending

2 Hours

Non-Traditional mortgage lending

2 Hours

General Elective

1 Hour

Remember to take into account the “successive years” rule, which prohibits loan officers from taking the same CE course two years in a row.

Mortgage Educators changes its continuing education course annually to ensure there are no issues with the successive years rule.

The deadline to complete CE in Tennessee is December 15th. MLO's in Tennessee are actually prevented from applying for license renewal until they have completed their CE.

Keep in mind you'll need to complete a background check and credit check if you have not in the last 3 years. The TN renewal fee is $100.

Mortgage Educators and Compliance is here to answer any additional questions you may have regarding your Tennessee mortgage license.

For additional questions, feel free to call us at (801) 676-2520 or email us at [email protected].

Get Your Tennessee Mortgage License with Mortgage Educators

In an effort to curb the predatory lending practices that led to the demise of the housing and residential mortgage industry in 2008, the Secure and Fair Enforcement for Mortgage Licensing Act (SAFE) was enacted. This opened up a world of opportunity to those driven to attain an MLO license and then work hard to match people with loan products.

| Topic | Hours Required |

|---|---|

| Fair Lending, Ethics, Fraud, and Consumer Protection | 3 Hours |

| Federal Laws and Regulations | 3 Hours |

| Non-Standard Lending | 2 Hours |

| Undefined Electives | 10 Hours |

| Tennessee Specific Education | 2 Hours |

| Total 20 Hours | |

If you complete the required 20 hours of education but do not obtain your license for a 3-year period, you'll need to repeat the coursework. The same applies if you let your license lapse for 3+ years before you want to get back into the industry.

A “mortgage broker” refers to an individual or an organization that connects consumers with mortgage loans from a variety of companies. Mortgage brokers frequently employ loan officers. In contrast, a loan officer is an employee who regularly works with borrowers and provides loans that are originated by their employer. Brokers and loan officers need different types of licenses.

Earning your mortgage broker license in Tennessee should be considered an investment well worth your time. Here’s what to expect when it comes to licensing fees in Tennessee:

| NMLS Fees | |

|---|---|

| NMLS Initial Processing Fee | $30 |

| Tennessee License & Registration Fee | $100 |

| Tennessee Application Fee | $100 |

| Credit Report | $15 |

| FBI Criminal Background Check | $36.25 |

| Total License Cost | $281.25 |

On an annual basis, Tennessee MLO license holders must complete 8 total hours of Comprehensive Continuing Education that must cover:

| Topic | Required Hours |

|---|---|

| Federal Regulations and Law | 3 Hours |

| Ethics, including consumer protection, fair lending | 2 Hours |

| Non-Traditional mortgage lending | 2 Hours |

| General Elective | 1 Hour |

Remember to take into account the “successive years” rule, which prohibits loan officers from taking the same CE course two years in a row.

Mortgage Educators changes its continuing education course annually to ensure there are no issues with the successive years rule.

The deadline to complete CE in Tennessee is December 15th. MLO's in Tennessee are actually prevented from applying for license renewal until they have completed their CE.

Keep in mind you'll need to complete a background check and credit check if you have not in the last 3 years. The TN renewal fee is $100.

Mortgage Educators and Compliance is here to answer any additional questions you may have regarding your Tennessee mortgage license. For additional questions, feel free to call us at (801) 676-2520 or email us at [email protected].

Are you excited about serving your community in Tennessee as a loan officer? Then take advantage of our special education bundle that will help you get your pre-license courses completed quickly. Gain the knowledge you need with Mortgage Educators today!