4 Reasons Why Becoming a Mortgage Broker or Loan Officer May Be the Career Change You've Been Looking For

What is a Mortgage Loan Officer?

Loan officers, also commonly referred to as "Mortgage loan originators" or "MLOs", are individuals employed by banks or financial institutions to help recommend the right loan to potential homebuyers. Loan officers are monitored by the Nationwide Mortgage Licensing System or NMLS, through which they obtain a license. This license is required both nationally and at the state level for loan officers to originate loans.

Mortgage Loan Officer vs. Mortgage Loan Broker

MLOs are commonly confused with mortgage brokers. If you are confused on the difference, perhaps this can help. When a homebuyer wants to get a loan, the homebuyer finds a mortgage broker to broker the loan. That means that the broker finds a loan officer to help originate that loan. Oftentimes, the mortgage broker works in the same office and manages loan officers.

So what's the difference between the two when it comes to education? To put it simply, nothing. Mortgage brokers and mortgage loan officers both must complete the same education requirements in order to obtain their license to operate in their state or states.

4 Perks to Being a Mortgage Broker or Loan Officer

Hopefully we have helped to clear up some initial confusion on the differences and similarities between a mortgage broker and loan officer. So that leaves the question: why should I become a mortgage broker or loan officer anyway?

We are glad you asked. Here are 4 things that we think makes this industry special and a sure-shot for anyone who is contemplating making the switch.

#1. Unlimited Income Potential

The mortgage industry is a self-starter industry. Most mortgage professionals are paid on commission with a percentage of each loan generated going towards the loan officer's paycheck. This mean that the income potential for each loan officer is only limited by their drive to originate loans by marketing their business and making connections. To put it plain and simple, you get out what you put in. The average commission for a loan officer is around 2% on every loan originated. The 2% rate is somewhat standard by regulations set in 2011 by the Federal Reserve Board.

To illustrate this average, let's say that a loan officer originates one $250,000 during the month.

$250,000 loan X 2% = $5,000

The 2% commission on that $250,000 loan that the officer originates will give the MLO $5,000 in commission for that one loan. If over the course of a year the MLO closed one loan per month over 12 months, that loan officer will have made $48,000 that year. Keep in mind that this scenario assumes only one loan originated a month. Most loan officers can close anywhere from 18 to 25 loans in a year, with some doing as many as 35 to 40. According to U.S. News, which ranks loan officers as #14 on its list of Best Business Jobs, the average salary for a loan officer in 2015 was $63,430 with the upper 75th percentile making over $90,000.

But that income comes at a cost: hard work. Originating mortgage loans is not a simple walk-in-the-park job. The life of a mortgage broker or loan officer is one that takes deadline management, marketing, communication skills and a desire to succeed. The industry also demands much from its loan officers as there are a number of government regulations, rules and laws to abide by in order to obtain and maintain a MLO license.

#2. Flexible Schedule and Lifestyle

After pay, one of the biggest perks of any career is how flexible it allows you to be. The good news is that mortgage brokers and loan officers work in one of the most flexible environments in the nation. Loans can be originated anywhere and everywhere. As long as you have a cell phone and computer with an internet connection, you can originate loans. Your reach is only as far as your license allows you to go! You could be in California and close a deal in Guam, or in New York closing a deal in Kentucky.

The flexibility and functionality of your license demonstrates the importance of choosing the right educator for obtaining your license. It is important so that you can find an education provider that is knowledgeable about the industry, can answer your questions, but can also provide you a wide range of education options to tailor your license to your individual needs. Mortgage Educators and Compliance has been in the business of mortgage education and licensing for 25 years and is a tried and true source for all your mortgage education needs. Trust us to point you in the right direction and to be with you every step of the way.

#3. Quality Market Situation

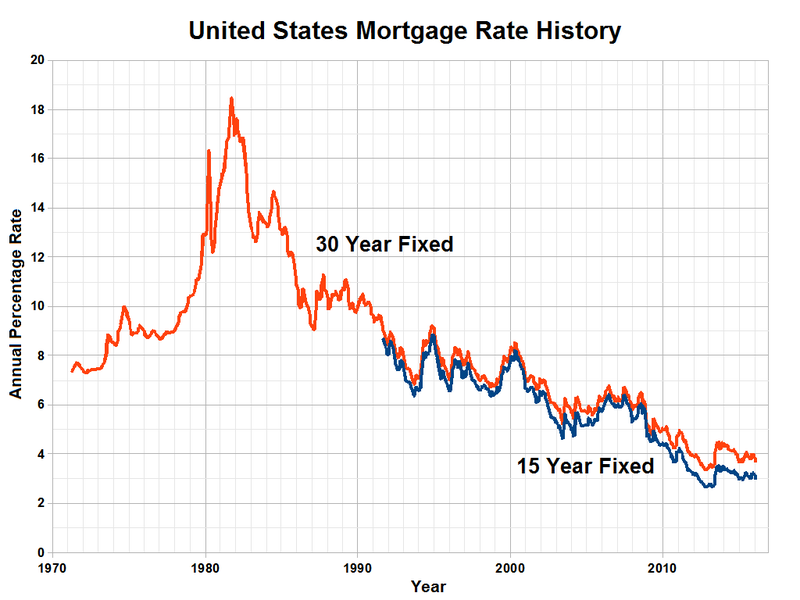

Every industry experiences its ups and downs but those holding a mortgage license can always know they have something to offer and a business that is in demand. Every day another person is looking to purchase a home in your neighborhood and you could be the one to help! Right now the industry has record low rates and they continue to fall. The below graph illustrates the trending decline in interest rates, which means more mortgages and refinances for you to originate for customers! It all depends on you and your willingness to take advantage of the opportunity.

#4. Helping People Achieve Their Home-buying Dreams

Buying a home is a scary ordeal, especially for first time homebuyers. The investment is huge and often the largest purchase any of us will ever make. So homebuyers need someone to help them through the process to make sure that securing a loan is a stress-free and simple procedure. Each loan officer has the unique opportunity to help homebuyers to secure the right loan for them so they have one less thing to worry about.

Being a mortgage broker or loan officer is a unique career that offers benefits and opportunities not found elsewhere. You've waited long enough to find the right career for yourself. Chances are that a career as a mortgage broker or loan officer is the career move you've been waiting for. It's never too late to get started on something amazing. There's an old saying -- "The best time to plant a tree is 20 years ago. The second best time is now." So get started today!

For questions about how you can get started on your way to become a mortgage broker or loan officer, call Mortgage Educators and Compliance at 877-403-1428.